Internet Sales Tax Update

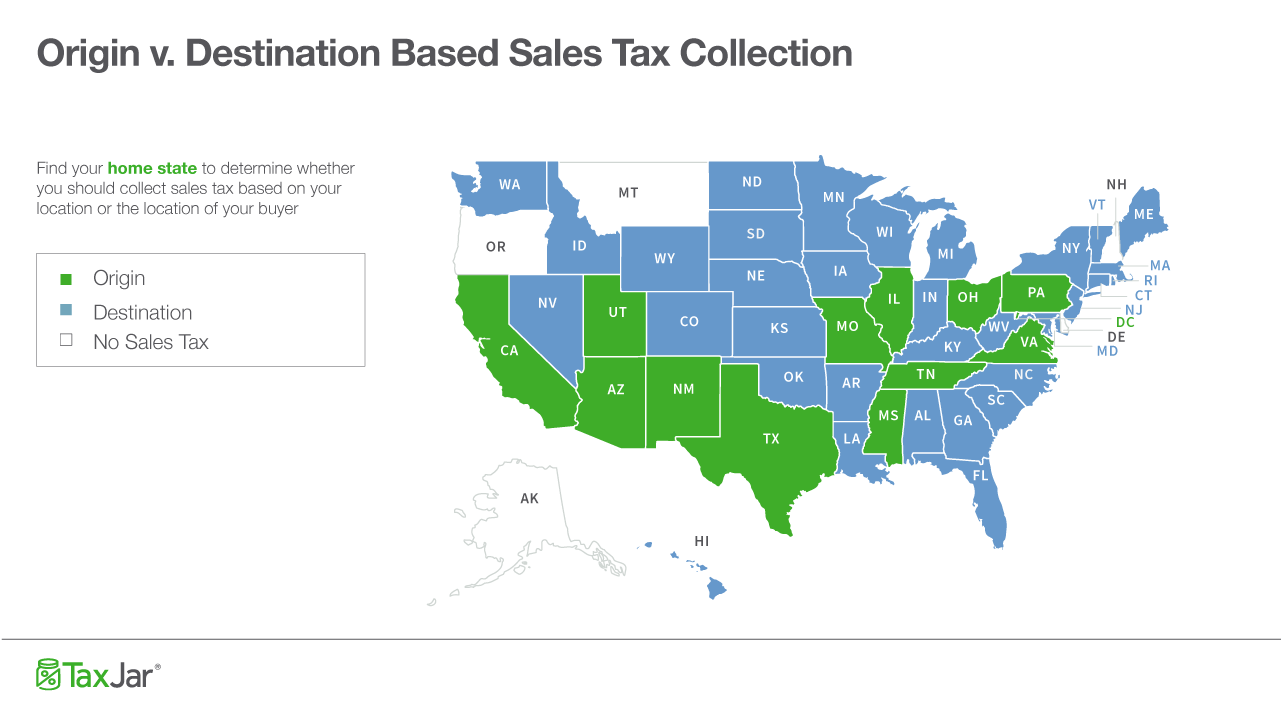

On June 21, 2018, The United States Supreme Court ruled that states could now force online shoppers to pay sales tax. If you are the current owner of an ecommerce store you are probably thinking “I already do charge sales tax – what does this ruling mean for me?”. The short answer is this – LOTS. As an ecommerce store owner you are already charging your customers sales tax, unless you/they are in one of the 5 states that do not collect a sales tax. Sales tax for ecommerce has always been a murky area. Most people aren’t tax professionals but it basically boils down to this. Up to this new ruling, states collected sales tax based on either origin of the product sold (your location) or the destination the product is being shipped to (your customer’s location). You can check out the map below to see where the various states stand on the issue and check out this article by Taxjar.com if you have any more questions on what is what.

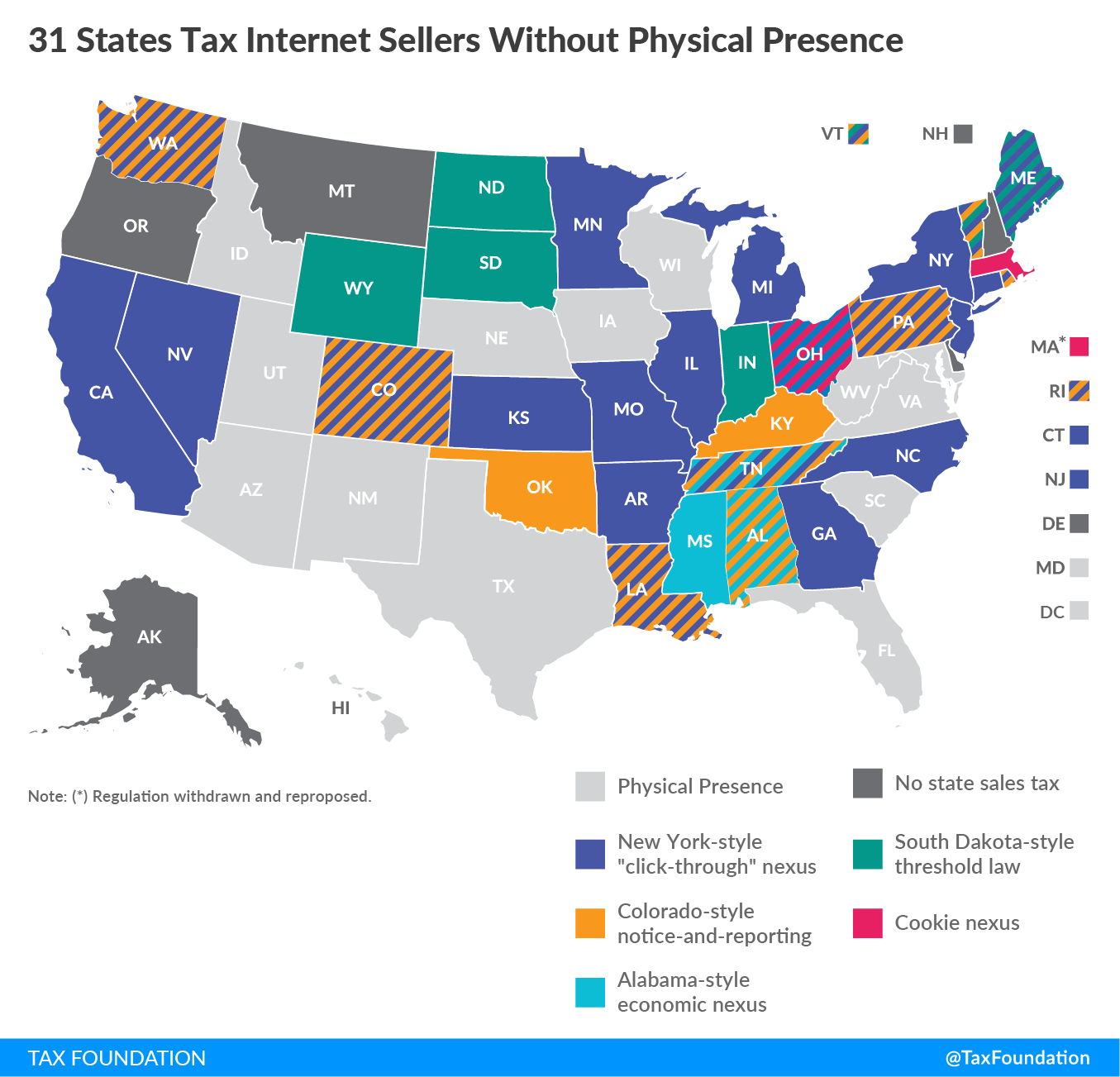

Really want to go down the rabbit hole of internet sales tax? Get ready for your head to explode before you look at the map below from Taxfoundation.org and you might decide the internet tax ruling might be a good thing to streamline rules and laws on this subject. This map is a good reference for those of us who are only familiar with the sales tax laws of our own states. As you can see below, the entire country is a hodge podge of rules around the subject. Want to know more about the “cookie nexus“? What about the New York, Colorado, Alabama or South Dakota-style nexuses and laws? If only we were talking about pizza…

The History Behind Internet Sales Tax

In 1992, The US Supreme Court ruled in the case of Quill Corp v. North Dakota that states cannot require retailers to collect sales taxes unless they have a “physical presence” in the state. So if you had your ecommerce shop located in Pennsylvania and you sold a product to a customer in Florida – you were not required to collect Florida sales tax from that customer. If a customer from Pennsylvania purchased a product, because PA is an origin-state you would be required to collect sales tax from your fellow Pennsylvanian. is new ruling overturns all of that. It won’t affect the states that are already requiring merchants to charge a sales tax based on destination too much but, those in the green states above will absolutely be affected. Why did this happen?

Back in 2016 legislators in South Dakota passed a law that required out-of-state online retailers to collect state sales taxes. The new law requires out-of-state online retailers to collect sales tax if they clear $100,000 in sales to South Dakota residents or have 200 separate transactions with customers in the state. The legislators of South Dakota, as well as a number of other states, saw the upward rise of internet sales and were infuriated that their states weren’t getting a piece of the action. When purchasing from a state following the origin model as described above customers were generally responsible for paying the sales tax to their home state themselves if they weren’t charged it, but most didn’t realize they owed it and few paid. By allowing states to require online retailers to collect sales tax, an estimated $13 billion a year of new tax revenue would flow into the coffers of the states. SAouth Dakota by itself would see an additional $50 million per year. After the law was enacted, the South Dakota state government preemptively sued four online retailers. Overstock.com Inc, Wayfair Inc and Newegg Inc contested the lawsuits, while the fourth company, Systemax Inc, decided not to. After losing in lower courts, South Dakota appealed to the Supreme Court, which announced in January it would hear the case. The case has been heard and on June 21, 2018 a decision rendered.

The SCOTUS Ruling on the Internet Sales Tax

Drumroll……….The Supreme Court ruled in favor of South Dakota, and its coalition of 39 other states, against the internet retailers and have granted states the broad authority to force online retailers to collect sales taxes. Not only is the ruling a win for the states but it is also a win for large online retailers who argued the physical presence rule was unfair and allowed competition from smaller businesses without a presence in the state. Large retailers such as Walmart, Target, Apple, Macy’s and Apple, which have brick-and-mortar stores, already generally collect sales tax from their customers who buy online. That’s because they typically have a physical store in whatever state the purchase is being shipped to. Amazon.com, with its network of warehouses, also collects sales tax in all 45 states that impose the though they have not generally collected taxes for items sold on its website by third party vendors which make up roughly half ofits total sales although two states have now enacted laws to require it to do so.

What This Means For Your Store

First thing, there is no need to panic. You will not be receiving letters in the mail from all 45 states collecting sales tax asking for their piece of the pie. There are many large online retailers that do not collect sales tax nationwide such as Blue Nile, Chewy.com, L.L. Bean and all the sellers who use eBay and Etsy.While things may move faster in South Dakota in regards to actively collecting sales tax for residents of that state it is safe to assume that other states will soon be enacting their own laws regarding this topic so you can expect to hear more about this in the near future. This ruling will make it harder for consumers to find deals online where they can avoid paying sales tax and overall many consumers will be charged more at their online checkout requiring many internet retailers to rexamine their pricing models to take the additional tax into account when the time comes. The thing to remember is that this is still a ruling but it is never too late to make sure you are on the right side of the sales tax law. We highly recommend being prepared for a future of more taxes being imposed on ecommerce stores and would suggest a plugin similar to the WooCommerce sales tax plugin provided by Taxjar which also looks at sales tax imposed by counties, cities and districts so you don’t have to go and research everything on your own.